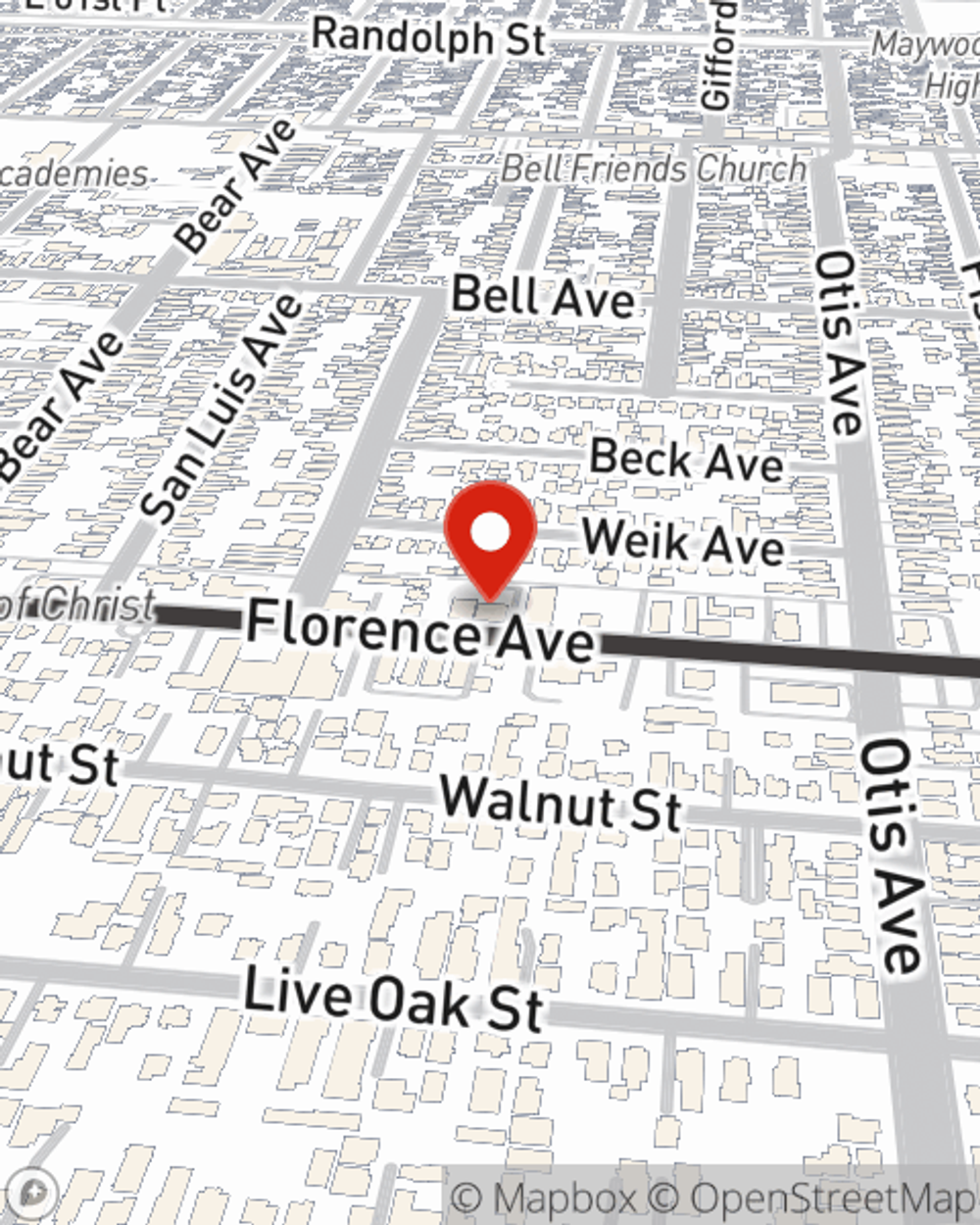

Business Insurance in and around Bell

Get your Bell business covered, right here!

Cover all the bases for your small business

Your Search For Great Small Business Insurance Ends Now.

Small business owners like you wear a lot of hats. From customer service rep to marketing guru, you do whatever is needed each day to make your business a success. Are you a plumber, a psychologist or an insurance agent? Do you own a book store, a bicycle shop or an art store? Whatever you do, State Farm may have small business insurance to cover it.

Get your Bell business covered, right here!

Cover all the bases for your small business

Small Business Insurance You Can Count On

Your business thrives off your creativity tenacity, and having great coverage with State Farm. While you lead your employees and put in the work, let State Farm do their part in supporting you with worker’s compensation, business owners policies and commercial auto policies.

As a small business owner as well, agent Alba Ramirez understands that there is a lot on your plate. Get in touch with Alba Ramirez today to discover your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Alba Ramirez

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.